This report examines the intense Singapore vs Hong Kong rivalry, two of Asia’s key hotel markets, both competing for supremacy in the post-pandemic era.

Singapore is currently ahead, with occupancy rates exceeding 83% in early 2024, leveraging its appeal to host significant global events. In contrast, Hong Kong is facing challenges, with a slow luxury market and changing visitor patterns. As Singapore’s average daily hotel rates climb to $314 and Hong Kong prepares for the grand opening of its new stadium in 2025, a major clash between these markets seems inevitable.

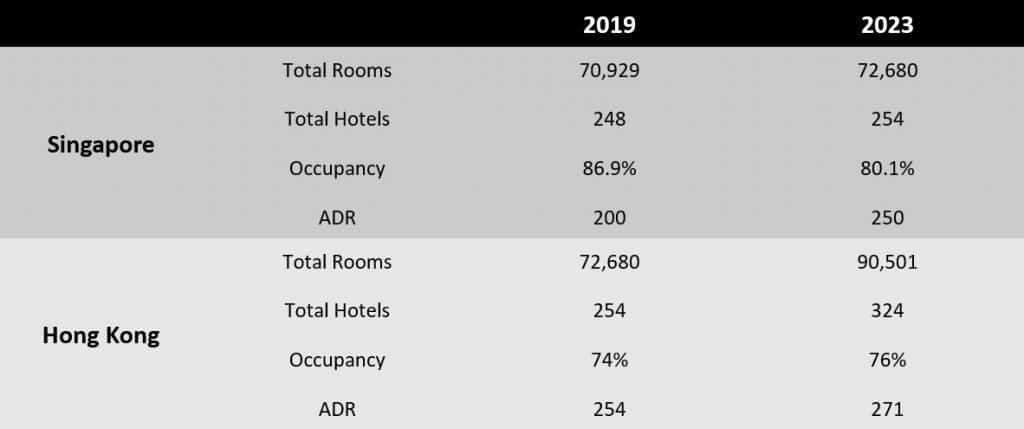

In 2019, just before the pandemic, Singapore achieved a long-awaited milestone by surpassing Hong Kong in annual revenue per available room (RevPAR). Despite a slight dip in occupancy in 2023 compared to 2019, Singapore has bounced back strongly. As of April 2024, it now boasts the highest occupancy rates in the Asia Pacific region.

In March 2024, occupancy levels reached 83.8%, just shy of the 84.3% recorded in the same month in 2019. This growth has been driven by higher rates, an influx of international tourists, and major events such as Coldplay and Taylor Swift concerts, which have significantly boosted the hospitality sector.

Singapore’s ability to attract large international events has been one of its key strengths, especially in contrast to Hong Kong, which is still working on completing its new 50,000-seat stadium, set to open in 2025. The key difference between these two destinations lies in how they operate. In Singapore, luxury hotels have seen a significant boost, with occupancy and rates hitting record highs in 2023. The RevPAR for luxury hotels reached an impressive US$282, and the data for March 2024 suggests that this trend is set to continue, possibly marking another record-breaking year.

Hong Kong, however, presents a different story. High-end hotels in Hong Kong have struggled, with occupancy rates in the high 70% range, significantly lower than the 87% seen in High Tariff B Hotels and 88% in Medium Tariff Hotels.

This shift highlights a growing trend of budget-conscious visitors, influenced by the strong Hong Kong Dollar, which is pegged to the US Dollar. As a result, Hong Kong has become less attractive to tourists, especially when compared to more affordable luxury markets like mainland China.

The average daily rates (ADR) for hotels in Hong Kong vary, with High Tariff A Hotels at US$309, High Tariff B Hotels at US$144, and Medium Tariff Hotels at US$97. In the luxury segment, where ADRs exceed US$385, occupancy ranges from 45% to 70%, although some operators have managed to maintain high room rates. However, concerns are growing about the drop in visitor spending in Hong Kong, as the city works to revitalize its tourism, retail, and hospitality industries.

Meanwhile, outbound travel from Hong Kong is picking up, returning to pre-pandemic levels. This increase is driven by improved accessibility within the Guangdong-Hong Kong-Macau Greater Bay Area and weaker currencies in destinations like mainland China and Japan, where Hong Kong Dollars stretch further. At the same time, Hong Kong itself has become more expensive for inbound tourists.

Looking at the global picture, STR data for Q1 2024 shows Hong Kong with an average occupancy of 73% and an ADR of US$204. Singapore, in comparison, has an occupancy rate of 77% and an ADR of US$314. Other key markets like Dubai, London, Mumbai, and Sydney also reported around 80% occupancy for the quarter.

In terms of ADR, cities like Paris (US$309), New York (US$231), and Dubai (US$226) are leading the charge. Both Singapore and Hong Kong have the potential to improve their rates and occupancy further, but the challenge remains in attracting higher-spending visitors and balancing attention between Mainland Chinese and international tourists.

Experts in the industry shared their insights on these developments. Kevin Croley, Senior Vice President of Development at Pan Pacific Hotels Group, expressed confidence in Singapore’s luxury sector. “The luxury sector in Singapore is performing well. We remain optimistic about the future, and we are currently developing another property on Orchard Road.”

On the other hand, Dan Voellm, CEO and Founder of AP Hospitality Advisors, noted the challenges facing Hong Kong. “The luxury sector is sluggish at this time. The currency peg to the US Dollar has made Hong Kong more expensive for many visitors.” He added, however, that local government efforts to generate events and attract people to the city make him hopeful for 2025.

Labour shortages continue to be a major challenge for both destinations, especially in Singapore, where attracting young talent to the hospitality sector remains a struggle in the post-COVID environment. This has led to some visitor dissatisfaction, with many feeling that the customer service falls short of the high prices charged by hotels.

Outlook

The future for the hotel markets in Singapore and Hong Kong remains cautiously optimistic. Both cities are experiencing growth in RevPAR, fueled by strong international travel and the strategic hosting of events. However, this growth could be limited by global economic uncertainties and geopolitical challenges.

Singapore’s strong momentum, driven by record occupancy levels, positions it as a regional leader. In contrast, Hong Kong faces the task of rejuvenating its luxury sector while also catering to budget-conscious tourists. As flight capacities recover to pre-pandemic levels, both markets have the potential to grow further, but navigating economic uncertainties will be essential for long-term success.

Click here to read the full report by: Global Asset Solutions

Read more: Latest