The Indian hospitality sector is set for substantial growth, with room count expected to reach 3.1 million by 2029 and surge to 4.1 million by 2034, according to market projections.

The Indian hospitality industry has been on a rollercoaster ride in recent years, with the pandemic causing severe disruptions, only to be followed by a promising recovery.

A comprehensive study by Hotelivate, authored by Harinya Sreenivas and Manav Thadani, delves into the current state of the hospitality market, focusing on market size, workforce dynamics, and future projections.

The findings provide a sharp analysis of the challenges and opportunities that lie ahead for one of India’s most vital industries.

Recalibrating Recovery

As the post-COVID global recovery is underway, this revival is tempered by ongoing geopolitical crises and economic fluctuations. The sector, much like its global counterparts, has been recalibrating to align with the new normal, marked by changing consumer behaviour, heightened health protocols, and a growing focus on domestic tourism.

The Supply Story:

The Hotelivate study takes a holistic approach by analyzing the broader accommodation inventory in India, including independent hotels, guesthouses, and short-term rentals. To fill gaps in previous data, the study incorporated insights from leading Online Travel Agencies (OTAs) and key industry stakeholders, painting a clearer picture of the true market size.

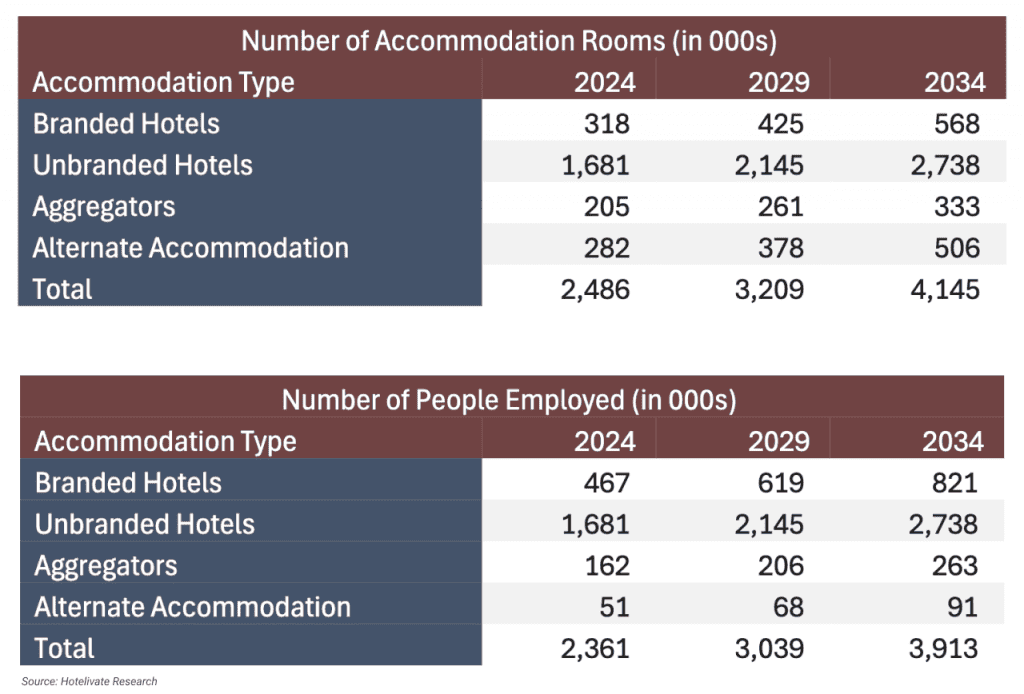

The report highlights India’s hospitality sector’s steady comeback with a recent analysis showing the country now has 2.48 million operational lodging rooms as of June 2024.

The report, which examines the full spectrum of accommodations from branded hotels to independent properties and aggregator chains like OYO, FabHotels, and Treebo, suggests the industry is on track for a strong rebound and continued growth in the coming years.

Pre-pandemic forecasts had predicted 3.3 million rooms by 2024, but the pandemic severely impacted the sector, particularly in the unbranded and aggregator segments, where around 15% of room capacity was lost due to closures. Despite these setbacks, the branded hotel sector has shown resilience, with an increase in new signings and hotel openings over the past two years. As tourism slowly returns, the industry is expected to recover to pre-pandemic levels by 2025, with the total number of rooms projected to reach 3.1 million by 2029 and 4.1 million by 2034.

Branded Hotels on the Rise

The analysis reveals that independent or unbranded accommodations still dominate India’s lodging market, accounting for 68% of the total supply. However, branded hotels are quickly growing in prominence, becoming the second-largest segment, thanks to increasing investment from both domestic and international players. This growth has been particularly evident in smaller cities and tier-2 markets, where branded hotels have gained traction due to rising demand for more standardized and reliable services.

“Branded hotels have bounced back strongly from the pandemic, with significant interest from investors and developers,” said a source close to the analysis. “This trend is likely to continue as smaller cities become more important hubs for both business and leisure travellers.”

The Rise of Alternative Accommodations in Indian Hospitality

Another key trend the report highlights is the growing popularity of alternative accommodations, such as homestays and guesthouses. These options have become increasingly attractive to travellers seeking more personalized and immersive experiences. The rise of these accommodations has been a bright spot for the industry, providing much-needed diversity in the types of lodging available across the country.

Meanwhile, aggregator chains, which faced significant closures during the pandemic, have also managed to hold their ground. New hotels have been opening under their banners, helping them maintain a steady share of the market over the past five years.

The Workforce Potential in Indian Hospitality

The hospitality sector has long been a significant source of employment, particularly for semi-skilled and unskilled workers. However, the pandemic-induced disruption has created uncertainty around workforce retention and growth. By correlating room inventory with workforce needs, the study highlights the sector’s capacity to absorb labour, potentially serving as a key pillar in India’s economic recovery.

As of June 2024, India’s hospitality industry employs 2.3 million people, maintaining its position as a key contributor to the country’s employment landscape. While this figure reflects a slight decline from the 2.4 million workers employed in 2019, the sector’s resilience amidst the pandemic has been evident. With an average of 0.94 employees per lodging room nationwide, the industry has proven its capacity to adapt and recover despite global disruptions.

According to the World Travel & Tourism Council (WTTC), India’s wider Travel & Tourism sector employed 37.21 million people in 2023, with hotels alone accounting for 6.21% of this total. As the sector continues to rebound, employment in hospitality is projected to rise significantly, reaching 3.0 million by 2029 and 3.9 million by 2034. A significant portion of this growth is expected to come from unbranded hotels, which, although employing fewer staff per room than branded establishments, will contribute substantially due to their sheer volume.

Employment Beyond Hotels

The hospitality industry’s workforce extends well beyond hotels. Employment opportunities are also created by clubs, restaurants, dhabas, banquet halls, and other hospitality infrastructure that is expanding rapidly across the country. These ancillary facilities, particularly in tier II and III cities, are expected to play a critical role in driving job creation. Projections suggest that 1.5 million new jobs will be added over the next decade, though the real figure could be even higher due to the continued growth of these associated industries.

“Employment in the hospitality industry is growing beyond traditional hotels, with job creation accelerating in other sectors like restaurants and event spaces,” said an industry analyst. “As India’s tourism sector continues to recover, the hospitality industry’s ability to generate employment will be a crucial factor in the country’s broader economic recovery.”

Growth projection

According to the report, several key trends are expected to shape its trajectory. Domestic tourism is poised to play an even more significant role, while international travel remains volatile. Sustainability, digitization, and personalized guest experiences are becoming non-negotiables in the post-pandemic world.

According to Hotelivate’s forecasts, the next decade will see the industry lean heavily into these areas, with government policies and investor interest aligning to further catalyze growth.

By mid-2024, the hospitality sector is demonstrating strong signs of recovery. Branded hotels, in particular, have seen significant growth in recent years, bolstered by investments in smaller cities and a steady stream of new hotel openings. Employment figures reflect this recovery, with an uptick in workforce numbers expected to continue as the sector expands to meet growing demand from both domestic and international tourists.

Future Outlook

- Looking ahead, the hospitality sector is expected to expand steadily over the next decade. As the domestic travel market continues to grow and international tourism picks up, the number of operational rooms will rise significantly, with branded hotels playing a larger role in the overall supply.

- The report also highlights the potential for alternative accommodations to continue expanding, offering more options for travellers who prioritize unique and flexible lodging experiences.

- With projections of room supply reaching 4.1 million by 2034, the sector is poised for significant growth, driven by domestic tourism, increasing business activity, and a resurgence in international travel.

- As investments pour in and the sector rebuilds after the pandemic, the workforce will play a pivotal role in shaping the future of Indian hospitality.

- As industry experts closely watch recovery trends, India’s hospitality market looks set to thrive in the coming years, offering a broader range of accommodation choices and contributing significantly to the country’s economy.

Read more: News