The annual Bain-Altagamma Luxury Goods Worldwide Market Study projects a new record as spending on experiences recovers to historic highs, fueled by a resurgence in social interactions and travel.

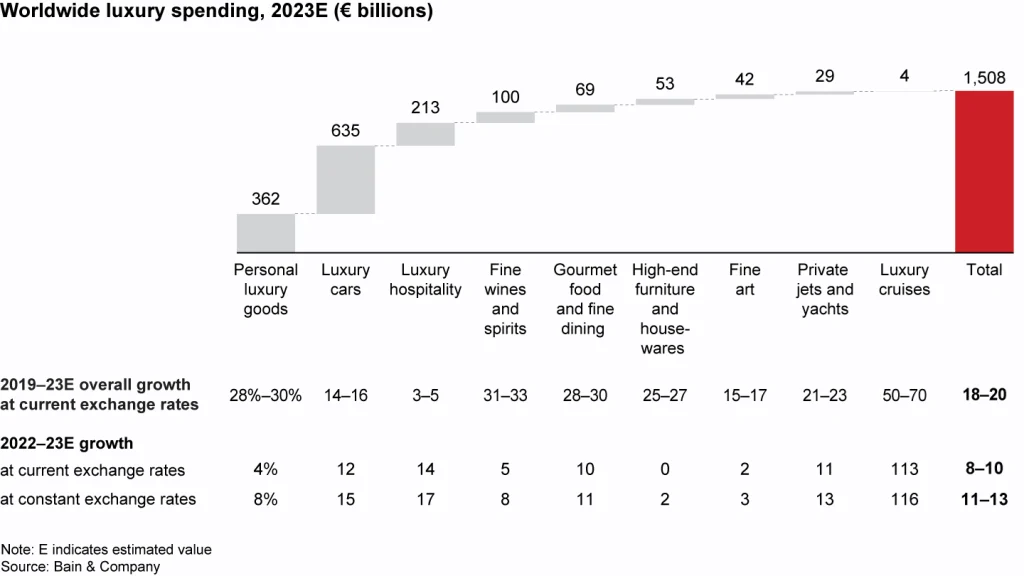

Despite challenging macroeconomic conditions, the report estimates the overall luxury market reached €1.5 trillion globally in 2023, a robust 8% to 10% growth over 2022 at current exchange rates (11% to 13% at constant exchange rates), setting a record for the industry and proving its unparalleled resilience. These are key findings from the 22nd edition of the annual Luxury Study, released by Bain & Company and Fondazione Altagamma, the trade association of Italian luxury goods manufacturers and put together by Claudia D’Arpizio, Federica Levato, Andrea Steiner, and Joëlle de Montgolfier

The overall luxury industry tracked by Bain & Company encompasses both luxury goods and experiences. It comprises nine segments, led by luxury cars, luxury hospitality, and personal luxury goods, which together account for more than 80% of the total market. The growth in total spending was consistent with the growth rate in 2022 and translated to a nearly €160 billion increment in spending across all luxury segments. In particular, spending on experiences recovered to historic highs, fueled by a resurgence in social interactions and travel.

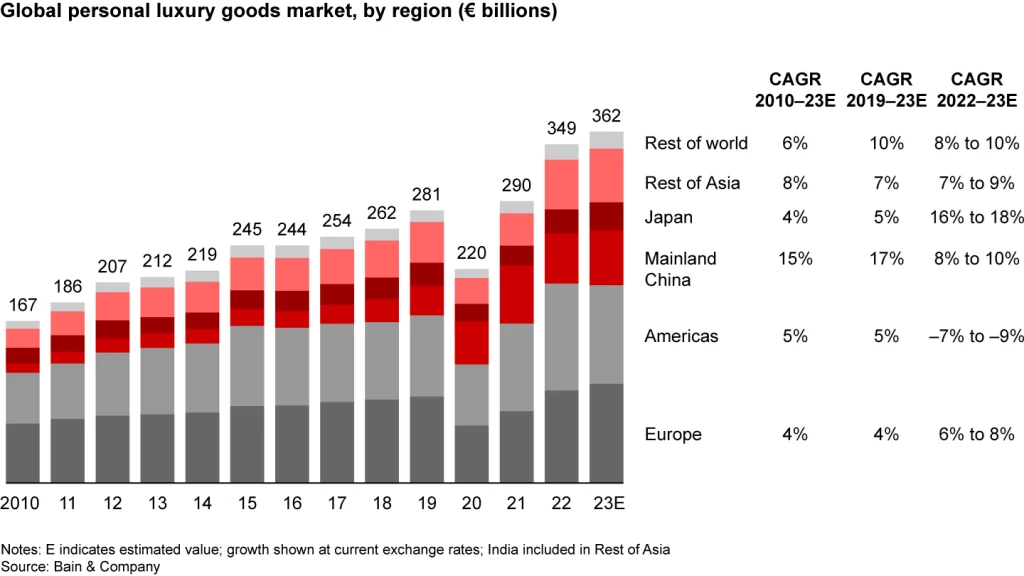

The market for personal luxury goods—the “core of the core” of luxury segments and the focus of this analysis—continued growing and is likely to have reached €362 billion in 2023, 4% higher than in 2022 at current exchange rates (8% at constant exchange rates). However, the market performance softened quarter by quarter, and uncertainty remained heading into the fourth quarter, with diverging signals coming from a reaccelerating Chinese market and decelerating markets in the US and Europe.

This slowdown has resulted in growing performance polarization. In 2023, the report estimates that about two-thirds of brands experienced growth (vs. 95% in 2022). Average profitability stabilized as a result of the counterbalancing forces of inflationary pressure and continued investment for the future against sustained price elevation.

Asia and Europe propelled luxury through 2023

Global luxury tourist purchases have nearly returned to pre-pandemic levels in absolute value, but upside potential remains (in particular, to catch up to pre–COVID–19 market share).

Asia set the pace for growth thanks to strong domestic demand and a renewed influx of Chinese tourists across the region. Japan boomed due to local customers and a weak yen favouring tourist inflows.

Mainland China posted a strong performance after its first quarter reopening but slowed progressively as new macroeconomic concerns arose. Southeast Asian countries experienced positive momentum from strong intraregional tourism and growing interest from local consumers, especially in Thailand.

Conversely, South Korea faced a challenging year, with unfavourable macroeconomic headwinds slowing local consumption, a strong currency that led tourists to buy elsewhere, and Korean outflows to international destinations.

Europe continued to benefit from the progressive pickup of tourism, which stimulated growth across all countries, with resort locations attracting high spenders alongside key luxury cities. Even if macroeconomic instability impacted local aspirational customers, the top customers maintained a positive momentum that fueled market growth.

Meanwhile, the Americas region has decelerated throughout the year, posting an 8% drop from 2022 as widespread uncertainty put a dent in aspirational customers’ spending. Top customers remained confident but shifted their spending abroad, as the US dollar remained strong against the Euro and price differentials favoured overseas purchases.

In the rest of the world, Saudi Arabia accelerated, attracting investments from major luxury brands, and Australia provided fertile ground for growth.

An unprecedented quest for in-store experiences – infused with digital

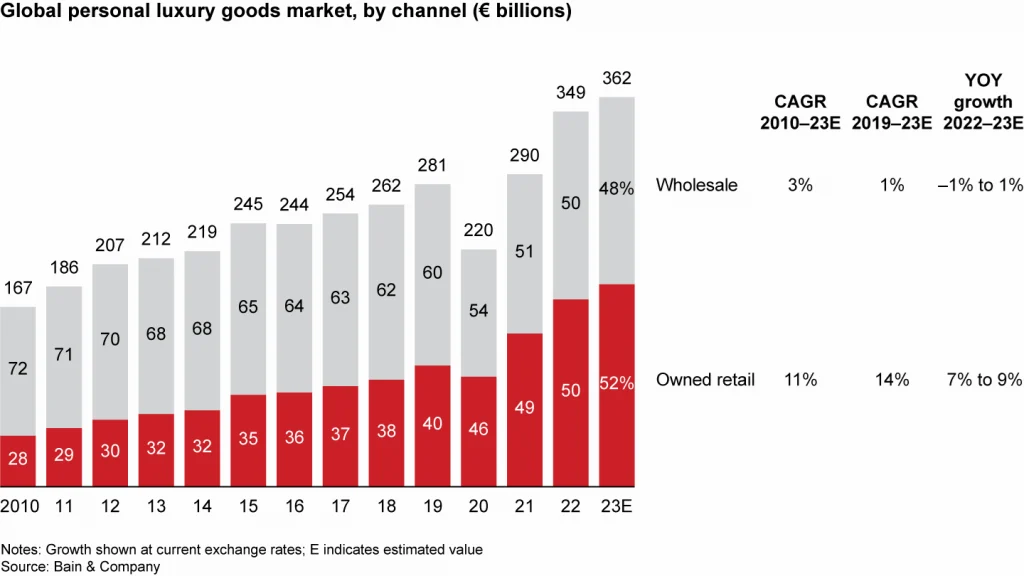

Monobrand stores led the distribution ecosystem, favoured by consumers’ thirst for a return to in-person interactions. Stores continued to blend physical and digital experiences, as epitomized by the increasing role of clienteling in sales.

Multi-brand environments suffered from a sharp slowdown in both department and speciality stores, with rising questions on their role and value proposition to best serve consumer needs in the future. Online market share, which is increasingly difficult to track separately from stores, saw a marginal erosion; within that channel, mono-brand websites experienced a normalization of their growth, while online retailers’ quest for traffic has pushed toward increased markdowns.

Jewellery shines

All personal luxury goods categories grew due to continued price elevation, partially undermining volumes for the first time in a decade. Fueled by an investment mindset, jewellery was set to reach €30 billion in market value in 2023, with fine jewellery affirming itself as a bright spot for investments amid uncertainty. Ready-to-wear was on a positive trend, favoured by top spenders in the ultra-high offering, with unfolding demand for excellence and durability.

Beauty, propelled by makeup and fragrances, enjoyed positive momentum thanks to the notorious “lipstick effect”—the phenomenon that consumers feel inclined to treat themselves to less costly luxury goods in times of economic crisis—in the Americas and Europe. Watches continued to thrive despite a rising polarization around a few industry winners. And after overperformance in recent years, growth in leather goods and shoes slowed.

Multigenerational complexity unfolds

Brands must navigate through rising multigenerational complexity. Generations X and Y are in their peak income years, representing the bulk of luxury purchases and the key pool of income growth in the near future. However, Generation Z is positioned at the forefront of social and cultural change, inspiring other generations’ value systems, with a strong desire for lived experiences and a quest for meaning.

By 2030, Gen Z will account for 25% to 30% of luxury market purchases, while millennials will account for 50% to 55%.

What’s next for luxury in 2024 and beyond?

Our research suggests a relatively soft personal luxury goods performance in 2024, achieving low- to mid-single-digit growth over 2023, based on current scenarios. Looki

ng ahead to 2030, solid fundamentals are poised to continue propelling market growth, despite possible bumps along the way. In an increasingly crowded market, brands must focus on creativity and innovation to enhance relevance to consumers, with the ultimate goal of continuing to expand their client bases while cultivating brand lovers. In a period of growth deceleration, brands will also need to pay attention to profit levels and rein in costs across the value chain.

This can include initiatives targeted at higher accuracy of business planning and demand forecasting with the help of artificial intelligence, tighter inventory management, cost variabilization, and more.

The report suggests a new season of M&A born of the necessity to address key challenges of the industry—for instance, to support category growth, expand in new geography, or secure control of critical resources or know-how. Leading on sustainability and embracing technology will continue to be key, in particular, to redesign supply chain setups for more transparency, agility, resiliency, and a lower carbon footprint.

Luxury spending trends in 2023

The overall luxury market tracked by Bain & Company comprises nine segments: luxury cars, personal luxury goods, luxury hospitality, fine wines and spirits, gourmet food and fine dining, high-end furniture and housewares, fine art, private jets and yachts, and luxury cruises. Luxury cars, luxury hospitality, and personal luxury goods together account for 80% of the total market.

The report estimates that in 2023 the luxury market’s overall retail sales value will grow to €1.51 trillion, an 11% to 13% increase over 2022 at constant exchange rates, in line with last year’s growth rate of 12% over 2021. All luxury segments grew and have finally closed the gap with pre–COVID–19 levels (including luxury hospitality, which has been the slowest to rebound). Since 2019, the Americas and Asia have been the two main sources of growth for overall luxury spending.

Sales of luxury cars, the biggest portion of the overall market, hit a new record, reaching an estimated €635 billion, 12% more than 2022 at current exchange rates and 15% above 2019. Following years of restricted growth from supply chain disruptions, luxury cars achieved substantial expansion across all segments, building on a robust order book. The absolute luxury segment grew the fastest due to increased demand for ultra-customized solutions, confirming the continued interest in sustainable powertrains.

The aspirational segment grew steadily, led by the rising popularity of electric vehicles. Within accessible segments, new Asian market entrants gained ground due to shifting consumer loyalty in the region. All brands continue to push to establish more direct relationships with their clients to enhance both the purchase and after-sales experiences. The role of online expanded, becoming an increasingly relevant purchasing channel.

The luxury hospitality market rose to an estimated €213 billion. It finally surpassed its pre–COVID–19 levels, propelled by increased occupancy and a stabilizing Average Daily Rate. The US and Latin America experienced positive momentum fueled by intraregional tourism. China remained below pre-pandemic levels despite reopening borders. Across regions, consumer expectations are rising as room rates stabilize at higher levels than in the past.

The Report saw a surge in the appetite for unique, personalized, and transformative experiences that foster a “disconnection” from normal life. High Net Worth and Ultra High Net Worth Individuals have heightened experience expectations beyond traditional luxury amenities.

Impact-consciousness, particularly among younger generations, favours more authentic and culturally immersive experiences and accelerates sustainable practices. Rising service expectations call for new technology solutions and data usage.

Sales of fine wines and spirits hit €100 billion, up 5% in 2022. Fine wines posted mild growth, with the resurgence of social interactions and conviviality occasions partially hampered by a downtrading of aspirational consumers. Sparkling and rosé wines showed the strongest momentum.

Spirits were on an upward trajectory; however, there were stark variations between meditation-driven (at-home) spirits, which decelerated, and mixology-led (out-of-home) spirits, which accelerated. While cognac and whiskey were impacted by reduced at-home time and the normalization of US consumption, agave-based spirits maintained strong momentum, stealing “share of throat” from gins on mixology occasions.

Gourmet food and fine dining grew 10% at current exchange rates to €69 billion. The strong growth in fine dining primarily stems from the growth of an “entertainment-is-the-star” segment.

The high-end furniture and housewares market remained steady at €53 billion. After the post-pandemic hypergrowth, the segment normalized, with the real estate market cooling down, although high-end residential projects continued demonstrating notable resilience.

The fine art market grew by 2% to €42 billion. Public auctions underwent a gradual downturn attributable to a lethargic US market and recent geopolitical disruptions, further compounded by inconsistent performance in Asia.

In contrast, dealerships expanded, extending their physical locations as collectors sought in-person interactions in the post–COVID–19 era. A shift toward Gen Y and the female clientele is noticeable, fueling an interest in subjects related to diversity, equity, and inclusion (DEI) and favouring the online channel. Following a continuous rise in prices in previous years, only select masterpieces held their anticipated valuations in 2023.

Sales of private yachts and jets grew by 11% at current exchange rates relative to 2022, reaching €29 billion. Luxury yachts continued growing, fueled by a strong order book accrued in previous years. Europe confirmed its role as a key region, while the US and China experienced slower growth due to more challenging macroeconomic fundamentals. The private jet market also continued growing, propelled by increasing enthusiasm for custom-made interior designs and rising interest in shared-ownership models and sustainable aviation fuels.

The market for luxury cruises reached €4 billion, more than doubling from 2022 as pandemic-related restrictions lifted. Consumers affirmed interest in the new ultra-luxury segment as well as unconventional voyages. Several high-end hospitality and travel players have progressively entered the segment, with one ship already launched and more than five planned for the near future.

When segmented into goods vs. experiences, discretionary spending rebalanced toward experiences in 2023. They observed the steepest growth rate at 15%, followed by experience-based goods (such as fine art and luxury cars) at 10%, and products at 3%. Demand for luxury experiences reached historic highs as consumers, fueled by a sense of longing for social life and travelling, reengaged with luxury beyond products.

The market for personal luxury goods—the heart of the entire luxury industry—saw its growth rate normalize at 4% at current exchange rates. Sales, however, hit a new record in 2023, with the market forecast to reach €362 billion by year-end. The most likely outcome in the fourth quarter of 2023 is a stabilization of sales compared to the last quarter of 2022.

- Growth has decelerated quarterly, and the fourth quarter faces headwinds with slowdowns in Europe and the US, but China is on a positive trend

- Global luxury spending hit a new record this year, with hospitality finally recovering above pre-pandemic levels

- Luxury spending continued to grow around the same pace as last year

- Since 2019, Asia and the Americas have significantly contributed to the growth in luxury spending

- Luxury-related experiences returned in 2023, fueled by a resurgence in social interactions and travel

- Luxury spending has shifted over time—products generally grow fast after crises, but there’s a long-term trend toward experiences

- Regional luxury spending varies meaningfully by segment

- Despite the uncertainty, personal luxury goods posted another year of growth

- Growth has decelerated quarterly, and the fourth quarter faces headwinds with slowdowns in Europe and the US, but China is on a positive trend

- Global luxury spending hit a new record this year, with hospitality finally recovering above pre-pandemic levels

- Luxury spending continued to grow around the same pace as last year

- Since 2019, Asia and the Americas have significantly contributed to the growth in luxury spending

- Luxury-related experiences returned in 2023, fueled by a resurgence in social interactions and travel

- Luxury spending has shifted over time—products generally grow fast after crises, but there’s a long-term trend toward experiences

- Regional luxury spending varies meaningfully by segment

- Despite the uncertainty, personal luxury goods posted another year of growth

- Growth has decelerated quarterly, and the fourth quarter faces headwinds with slowdowns in Europe and the US, but China is on a positive trend

Regional highlights

The global ranking by region changed in 2023, as Europe regained the top position for personal luxury goods sales. The Americas decelerated and switched to the second position, followed by mainland China.

Consumption was strong in Europe at €102 billion. All markets fared well, despite the deceleration of purchases by local customers throughout the year due to macroeconomic uncertainty. However, Very Important Customers and tourists kept positive momentum.

Our analysis of Global Blue tax-free spending data shows that the spending of US tourists in Europe has grown 2.5 times between 2019 and 2023, while that of tourists from the Middle East has been multiplied by 1.7 over the same period. However, spending by Chinese tourists is yet to recover, at about only 40% of its 2019 level. Overall, spending by tourists on luxury goods in Europe grew by 50% over 2022, entirely propped up by higher ticket value, as both the number of shoppers and the number of purchases declined.

The personal luxury goods market reached an estimated €101 billion in the Americas region, declining 8% over 2022. The market decelerated throughout the year, with aspirational customers hitting the brakes on luxury purchases. However, top customers still held up, yet partially shifted their spending abroad and toward luxury segments other than products. Most countries in Latin America suffered, except for Mexico.

Mainland China grew by 9% at current exchange rates over 2022. The year started strong but progressively slowed as macroeconomic concerns arose. The economic stimulus from the third quarter is likely to encourage growth of local consumption as well as investments in new Tier 1 megacities.

Hainan is poised to become a bright luxury hub, as China plans to make it an entirely duty-free island (with an ad-hoc tax system) by 2025.

Asia (excluding mainland China and Japan) grew by 8%. Southeast Asia confirmed its positive momentum, anchored in a growing local customer base, sound tourism flows, and foreign investments. Thailand led in terms of growth. Hong Kong and Macao boomed back in the first half of the year yet decelerated in the second half due to soft touristic inflows.

Local consumption slowed down in South Korea due to unfavourable macroeconomics and a strong currency that led tourists to other destinations; however, South Korea remains a primary source of influence in the region.

Japan was the fastest-growing region at 17% at current exchange rates over 2022, up to €29 billion. The market benefited from renewed energy and the interest of local customers. A weak yen attracted tourist inflows (especially from China) throughout the year, with luxury products as one of many spending items. Brands struck exclusive partnerships with local craftsmanship and creativity to increase their cultural relevance.

The rest of the world grew at 9% at current exchange rates to reach €17 billion. The Middle East showed strong growth across the board, but the war resulted in an abrupt shock that created uncertainty for the coming months. Dubai remains the key regional hub. Saudi Arabia is accelerating and still offers large untapped potential that attracts investments from major luxury brands. Australia is proving fertile ground for growth, with local labels starting to gain interest among luxury consumers.

Globally, tourism has been reinvigorated with the reopening of borders that followed the lifting of COVID-19 lockdowns at the end of 2022. In absolute value, tourists’ spending on luxury items is almost back to its pre-pandemic levels, but with a share of only 30% of global luxury purchases, compared with 40% in 2019, there is still room for growth.

Globally, tourists’ spending is nearly back to pre-pandemic levels in absolute value, but there’s still room to grow. America’s growth decelerated significantly, while Japan grew the fastest American customers remained the most active, and Europe benefited from international tourism.

Globally, tourists’ spending is nearly back to prepandemic levels in absolute value, but there’s still room to grow Americas’ growth decelerated significantly, while Japan grew the fastest American customers remained the most active, while Europe benefited from international tourism. Globally, tourists’ spending is nearly back to pre-pandemic levels in absolute value, but there’s still room to grow

Distribution trends

Brands continued to exert more control over their distribution, with directly operated channels increasing in importance again. For the first time, the retail channel’s share surpassed the wholesale channel, at 52% and 48%, respectively.

Monobrand stores grew by about 11%, boosted by the willingness of customers to return to in-person shopping. That said, customer journeys increasingly blended physical and digital touchpoints. Over the past two years, net store openings have declined by 40% to 45% compared with pre-pandemic trends, but brands have pushed to increase average store sizes, to make space for more experiential shopping journeys.

The online channel growth decelerated compared with previous years, as consumers favoured physical interactions after years of restriction, resulting in a slight erosion of the channel’s market share, down to about 20%. Within that channel, the growth of mono-brand websites normalized; e-tailers pushed on markdowns.

Department and speciality stores struggled due to uncertain value propositions that resulted in high inventory levels and markdowns. Travel retail was reignited by the return of global tourists. The off-price channel grew, benefiting from a surplus of inventory and propelled by aspirational customers seeking bargains.

The secondhand luxury goods market rose to €45 billion in 2023. Sales growth eased 4% to 6%, in line with the 4% gain posted by luxury goods—a confirmation of the normalization of “preloved” items already observed last year. Europe remained the largest market, accounting for around 45% to 50% of global secondhand luxury sales; the US followed as the second-largest market, with growing interest in preloved timeless bags.

Hard luxury (defined as the combination of watches and jewellery) still represents more than 80% of the total market. Secondhand increasingly acts as a market gateway for younger generations, as well as for aspirational consumers who want to continue participating in the luxury ecosystem, despite brands’ continued price elevation and general macroeconomic challenges.

The secondhand luxury market continued to expand, primarily propelled by hard luxury goods. Owned retail gained further ground, surpassing wholesale Monobrand stores grew strongly, fueled by consumers’ quest for in-person experiences; travel retail was revitalized but still below 2019 levels. The secondhand luxury market continued to expand, primarily propelled by hard luxury goods. Owned retail gained further ground, surpassing wholesale Monobrand stores grew strongly, fueled by consumers’ quest for in-person experiences; travel retail was revitalized but still below 2019 levels. The secondhand luxury market continued to expand, primarily propelled by hard luxury goods

Individual category performance

All personal luxury goods categories grew in 2023, albeit at lower growth rates than in the last two years. Apparel and jewellery were the fastest-growing categories, both with a growth rate of 5% to 6% over 2022.

Accessories remained the largest personal luxury goods category, growing by 2% to 4%. Within accessories, leather goods grew by 3% to 4%. After repeated overperformance in the last years, the category’s growth has slowed, with most growth coming from price increases and volumes decreasing for the first time in the decade. We observed heightened demand for “core” items as well as more exclusive investment pieces. Small leather goods won over aspirational and younger consumers.

Shoes grew by 2% to 3% compared with 2022 to reach €28 billion. It was the slowest-growing category due to its heavy reliance on aspirational shoppers. Formal and special occasion shoes normalized after last year’s strong acceleration. The sneaker category is maturing, aligning its growth rate with the broader category. There are signs of growing interest for performance-oriented products, from outdoor booties to technical sneakers.

The apparel category grew by 5% to 6% in 2023, aided by wardrobe elevation. The elevated post-streetwear wave is consolidating, especially in menswear. Top spenders ensured strong growth in the ultra-high offering, with unfolding demand for excellence and timelessness. Fashion-led items were less popular than core products that are closer to brand heritage and DNA.

Beauty reached €72 billion, up 4% to 5% in 2022. Makeup is enjoying positive momentum, with the “lipstick effect” continuing to attract aspirational clients. Ultra-luxury and celebrity fragrances are taking off, with artificial intelligence contributing to new and unique scents. Skincare is meeting temporary headwinds in Asia, linked to the declining popularity of Korean beauty routines in younger generations, as well as local policies constraining travel retail.

Watches are still thriving. Sales of new watches grew by 3% to 4% and reached a record €55 billion. Both high-end and entry items performed better, while mid-range items softened. Besides luxury industry giants, smaller direct-to-consumer brands with innovative value propositions are attracting collector communities. Generation Z continues to show strong interest in the category.

Jewellery sales in 2023 are estimated to have risen to €29 billion, up 5% to 6% from 2022. Consumers view fine jewellery as a bright spot for investment amid uncertainty. Demand for bespoke pieces is holding up, flanked by growing interest in “repetitive” high jewellery targeted at the ultra-rich. Fashion jewellery continues to accelerate, as do the genderless and male segments. Jewellery, apparel, and beauty grew the fastest. Accessories remained the largest category but grew more mildly than in the past

Outlook for the future

2023 has been an unsettling year for luxury. After two years of outstanding post–COVID–19 rebound, defined by double-digit growth rates, the sector saw quarterly growth progressively decelerate back to low single-digit rates. While such growth normalization was predictable, not every luxury company was able to anticipate and successfully navigate this trend. As a result, only about two-thirds of luxury brands were able to post growth in 2023, compared with about 95% from 2021 to 2022.

In such an environment, profits came under slight pressure. The report expects profit levels, which had recovered post–Covid-19 to an average 21% in 2021 and 2022, to range between 19% and 22% this year at best. While the industry has continued to benefit from increased prices and a confirmed shift to higher-margin direct channels, profit levels also reflect luxury brands’ increased marketing spending, as well as higher labour costs and energy prices.

But brands have nonetheless continued investing in modernizing their operations and infrastructure to support future growth. In particular, they are investing in more robust information technology and data infrastructure to support the ongoing digitalization of the industry, as well as renovation of their store networks.

In periods of turbulence, winning brands generally exhibit an unwavering commitment to invest in their future: They distinguish themselves by superior investment in brand visibility (spending on average 20% more than non-winning brands on marketing), general infrastructure (investing 20% more in capital expenditure), and the reinforcement of their organization (growing their number of employees by 30% more).

Looking ahead, the report expects overall luxury spending to experience sound growth of 4% to 8% per annum, from an estimated €1.5 trillion today to €2.5 trillion by 2030.

With regard to personal luxury goods, the report forecasts that the segment should grow moderately in 2024, ranging between 1% and 4% in our most realistic scenario, which anticipates tourist spending growth, the recovery of the US market, an acceleration in China and the Middle East, and the normalization of Japan.

A more positive scenario, anchored in the same assumptions with the addition of higher levels of consumer confidence that propel local demand across regions and accelerated recovery patterns in the US, would translate into 5% to 7% growth in 2024.

Beyond that, the report expects solid market fundamentals to result in annual growth rates between 5% and 7% until 2030. We anticipate that the market value of personal luxury goods will therefore rise to €540 billion to €580 billion by the end of the present decade. This would be twice the value of that same market back in 2019 (then estimated at €281 billion).

Four vectors of transformation should profoundly reshape the luxury goods market by 2030:

- Chinese consumers should regain their pre–Covid-19 status as the dominant nationality for luxury goods, growing to represent 35% to 40% of global purchases.

- Mainland China should overtake the Americas and Europe to become the biggest luxury market globally (24% to 26% of global purchases).

- Younger generations (Generations Y, Z, and Alpha) will become the biggest buyers of luxury by far, representing nearly 85% of global purchases.

- Monobrand stores and online should become the leading channels for luxury purchases, representing an estimated 60% to 66% market share.

- By 2030, Generation Y will remain the primary personal luxury goods buyers; online and mono-brand stores will be the leading channels

- In 2024, personal luxury goods could grow modestly, but by 2030, solid fundamentals should lead to sound growth

- By 2030, Chinese consumers should become the top personal luxury goods customers again and China the biggest market

Read more: Latest