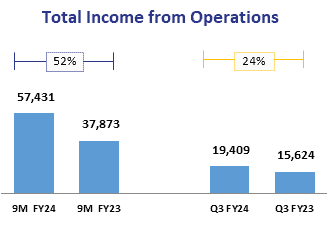

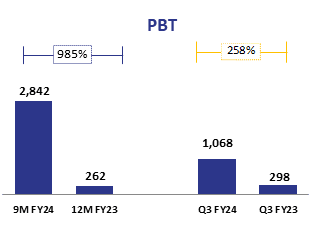

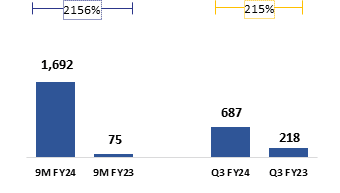

Thomas Cook India Group registers a PBT of Rs. 2,842 Mn for 9M FY24 against Rs. 262 Mn for the full year of FY23.

Key Performance Highlights (9M FY24):

- Thomas Cook (Standalone) PBT at Rs. 1,256 Mn Vs Rs. 188 Mn – growth of 7x

- Sterling Holidays PBT at Rs. 899 Mn Vs Rs. 515 Mn – growth of 75%

- Turnaround of overseas travel businesses: EBITDA at Rs. 529 Mn Vs Rs. 90 Mn – growth of 5x

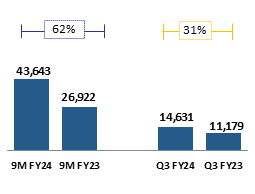

- Consolidated Basic Earnings per share increased from Rs. 0.30 to Rs. 4.36

Key Performance Highlights (Q3 FY24):

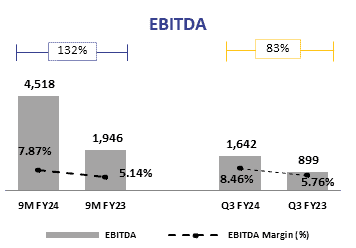

- EBIDTA Margin improvement by 270 bps to 8.46%

- Thomas Cook (Standalone) PBT at Rs. 159 Mn in Q3 FY24 Vs a loss of Rs. 64 Mn in Q3 FY23

- Sterling Holidays PBT at Rs. 343 Mn in Q3 FY24 Vs Rs. 197 Mn in Q3 FY23 – growth of 74%

- Overseas travel businesses EBITDA at Rs. 336 Mn in Q3 FY24 Vs Rs. 239 Mn in Q3 FY23 – growth of 40%

Other Highlights for Q3 FY24:

- Thomas Cook (India) Limited was added to the MSCI (Morgan Stanley Capital International Index) Domestic Small Cap Index

- The Offer for Sale (OFS) of 40 Mn equity shares of TCIL, valued at Rs 5.58 Bn by Fairbridge Capital (Mauritius) Limited was subscribed by 2.4x

- The Group’s Cash & Bank balances stood at Rs. 16.33 Bn as of Dec 31, 2023.

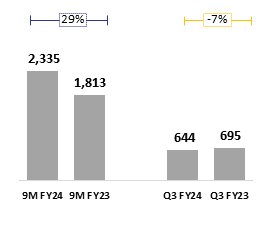

Significant growth in Total Income from Operations across all Business segments in Q3 FY24

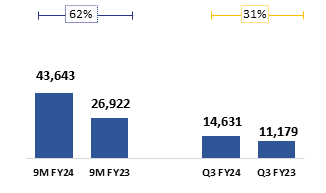

Travel Services

- Leisure Travel: 103% YoY Sales growth for 9M FY24; 33% YoY for Q3 FY24 across Thomas Cook & SOTC

- MICE: 90% Sales growth for 9M FY24; 76% YoY for Q3 FY24

- Corporate Travel transactions grew by 20% for 9M FY24; 115% YoY for Q3 FY24

- Travel Corporation (India) Limited: 170% growth in turnover for 9M FY24; 156% YoY for Q3 FY24

- Overseas Travel Businesses grew by 31% YoY in 9M FY24; 13% YoY for Q3 Q3 FY24

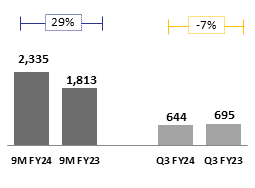

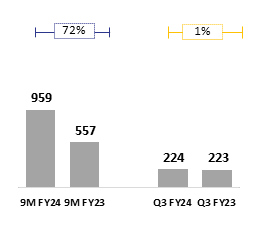

Forex

- Growth in sales: 30% for 9M FY24; 8% YoY for the quarter

- Retail growth: 19% for 9M FY24; 5% YoY for the quarter

- Overseas Education: 16% YoY for Q3 FY24

- Crossed 100+ forex transactions via WhatsApp

- Card loads grew by 26% YoY for Q3 FY24

- New prepaid card issuance up by 13% YoY for Q3 FY24

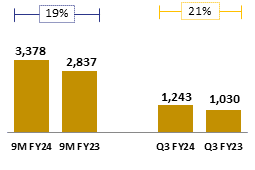

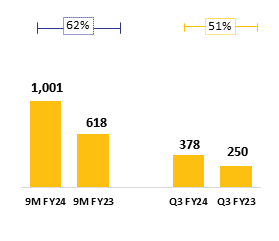

Hospitality (Sterling Holidays)

- Growth in sales: 19% for 9M FY24; 21% YoY for Q3 FY24

- Significant growth in PBT: 75% 9M FY24; 74% YoY for Q3 FY24

- Occupancy at 60% for Q3 FY24 with room capacities growing by 12% during this period

- Revenue grew on the back of higher non-member occupancies, which improved by 8% for the quarter

- New resorts launched in Q3 FY24: Udaipur’s Balicha and Jaisinghgarh

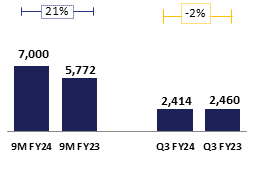

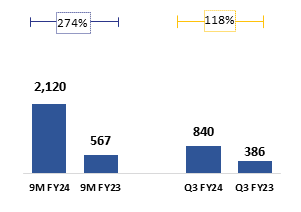

Digital Imaging Solutions (DEI)

- Growth in sales: 21% for 9M FY24

- EBITDA grew by 21% for 9M FY24; 15% YoY for Q3 FY24

- Q3 FY24 saw the addition of 11 new partnerships in Indonesia, Malaysia, India, Saudi Arabia and UAE

- Renewal of 7 key partnerships in India, Maldives and UAE

- Operational launch of 13 partnerships in Singapore, Indonesia, Malaysia, Hong Kong, India, UAE and Saudi Arabia

Madhavan Menon, Executive Chairman, Thomas Cook (India) Limited said, “The Thomas Cook India Group delivered another strong performance – driven by buoyancy in consumer demand for travel which is no longer seasonal. This is reflected in the McKinsey Report that forecasts a doubling of overall consumption by 2030. Backed by high travel propensity, the report also highlights India’s growth potential – from 13 million outbound trips in 2022 to 80-90 million in 2040.”

The proposed policy around money changing that has been circulated by RBI is likely to bring consolidation in the industry. Additionally, the proposition to permit AD II to undertake trade transactions up to a specified limit will enable more participation and better access to customers.

The focus across the Group will remain firmly on margins, productivity enhancement via technology and benefits of cost re-engineering while ensuring best-in-industry customer experience.”

Business Segment-wise Performance:

Foreign Exchange

- Room Revenues grew by 18% and Food & Beverage (F&B) revenues by 15% in Q3 FY23

- Average room revenues (ARR) in Q3FY23 increased to Rs. 6500 plus with product upgrades at various locations

- OFCF generated during the quarter was at Rs. 354 Mn and grew by 6%

Travel Services

Corporate Travel

Q3 FY24: Acquisition of new accounts across sectors like IT/ITS, Manufacturing, Automobiles, Banking & Finance, Consulting, Entertainment and retention of key global accounts

- Over 46% adoption by clients on the corporate self-booking tool in Q3 FY24

- Meetings-Incentives-Conferences-Exhibitions (MICE)

Q3 FY24: Managed over 120 groups – 15 to over 2000 delegates to Abu Dhabi, Dubai, Spain, Indonesia, Hong Kong, Singapore, South Africa, Hungary, Thailand; also Rajasthan, Maharashtra

- Concluded the 37th National Games in Goa; exclusively managed accommodation, catering and transportation services for approx. 17,000 guests – 11,400 athletes, 5,000 support staff & technical officials, 2,000 dignitaries

- Official partner for JIO MAMI; managed over 100 national and international personalities

- Professional Congress Organizer (PCO) for International Solar Assembly’s (ISA) 6th edition managing over 500 international delegates from 116 countries; including 20 ministers

Leisure Travel

- First to launch Europe Summer Holidays 2024 – in Oct 2023; attractive early bird offers to inspire bookings

- Introduced wide range of Vegetarian & Jain Festive Tours

- Launched land plus cruise programs on Costa cruises from Mumbai, Kochi, Goa, Agatti – Lakshadweep

- Destination Management Services Network

- India – Travel Corporation (India) Limited: Reported significant growth in turnover of 170% YoY for 9M FY24; 156% YoY for Q3 FY24

- Middle East – Desert Adventures: Q3 FY24 witnessed strong volumes led by CIS countries and Indian sub-continent markets

Private Safaris:

- East Africa: Surpassed pre-pandemic levels for the quarter. Q3 FY24 witnessed healthy sales supported by good volumes generated from traditional markets such as US, UK, Germany and Romania

- South Africa: Surpassed pre-pandemic levels for the quarter. Q3 FY24 witnessed encouraging volumes; growth is driven by key markets like Germany and France

- USA – Allied TPro: Q3 FY24 witnessed encouraging performance, driven by inbound passengers from European market. Volumes led by FIT

- Asia Pacific – Asian Trails: Strong volumes in Thailand, Malaysia, Singapore and Vietnam with an upward recovery trajectory in Laos and Cambodia.

Digital Imaging Solutions (DEI)

- Focus on Digitalization

- The Group’s Digital First strategy saw sustained momentum

- Launch of a fully automated process of managing and measuring CXI (Customer Experience Index)

- Integration of Sterling Resort properties into Thomas Cook and SOTC websites

- Online booking integration to book travel insurance for customers

- India Network Expansion

Leisure Travel:

- Franchise outlets opened in Delhi (South Extension II and Dwarka) and Hyderabad (Gachibowli)

- Foreign Exchange: an outlet opened in Tamil Nadu (Chennai)

Awards and Partnerships

- SOTC Travel won two awards for the 2nd time at The Economic Times Travel & Tourism Annual Awards; ‘Outbound Travel Operator of the Year’ and ‘Domestic Tour Operator of the Year’

- Thomas Cook India wins ‘MICE Travel Operator of the Year’ at The Economic Times Travel & Tourism Annual Awards – second edition.

Report courtesy: Thomas Cook India

Read more: News